Welcome to Spurr West

Your books and taxes, handled

Tax preparation, strategy, bookkeeping and peace of mind

We Have the Expertise

Tax accounting is in the family. Newton Spurr, CPA started the Spurr family firm in the 1970s. Sons Michael and Bradley Spurr continue the legacy today. Michael is a CPA with MS in taxation.

Andy Horwitt, CPA, joined as tax manager in 2024. He brings 30 years’ experience. He has a specialty in trusts and estates. Our remaining CPAs, tax preparers, and client support team bring their own specialties and experience. We’re the weirdos who actually enjoy tax accounting.

Personal Tax

Tax Prep & Strategy-

Individual & Trust Tax Returns

-

Dedicated CPA and Tax Manager

-

Tax Strategy & Planning Packages

-

"Anytime Access" Packages

Business Tax

Inclusive Packages-

Business Tax Return

-

Owner Personal Tax Return, included*

-

Annual Financial Review

-

"Anytime Access" Packages

Bookkeeping

Monthly-

Monthly Bookkeeping

-

P&L and Balance Sheet

-

Regular Financial Meetings

-

Discounted Tax Prep

Local and Virtual

We are a Northern California firm located in Sonoma County, Sacramento, and San Francisco. Most of our clients choose to work with us virtually, but your CPA is nearby if you prefer to work face-to-face.

How it Works

- DISCOVERY

Schedule a discovery call. Let us know of your most important need. Is it a personal tax return? A business tax partner? Monthly bookkeeping? Before we meet, we’ll ask you a few questions and request your most recent tax return. Our discovery call is our opportunity to learn about you and you to decide how we can help.

- GETTING TO WORK

We’ll get to work. If it’s taxes, we’ll gather and prepare your returns. If it’s bookkeeping, we’ll set a 3-6 month expectations and drive towards them. Use our easy online portal to send your information and documents. When finished, we’ll send you a secure link to view and sign your return.

- ADVICE & PLANNING

Before and after your taxes are filed, you have questions. We’ll be available for support and guidance and year-end tax planning. If you’re a bookkeeping client, we’ll be scheduling these regularly.

Online Convenience

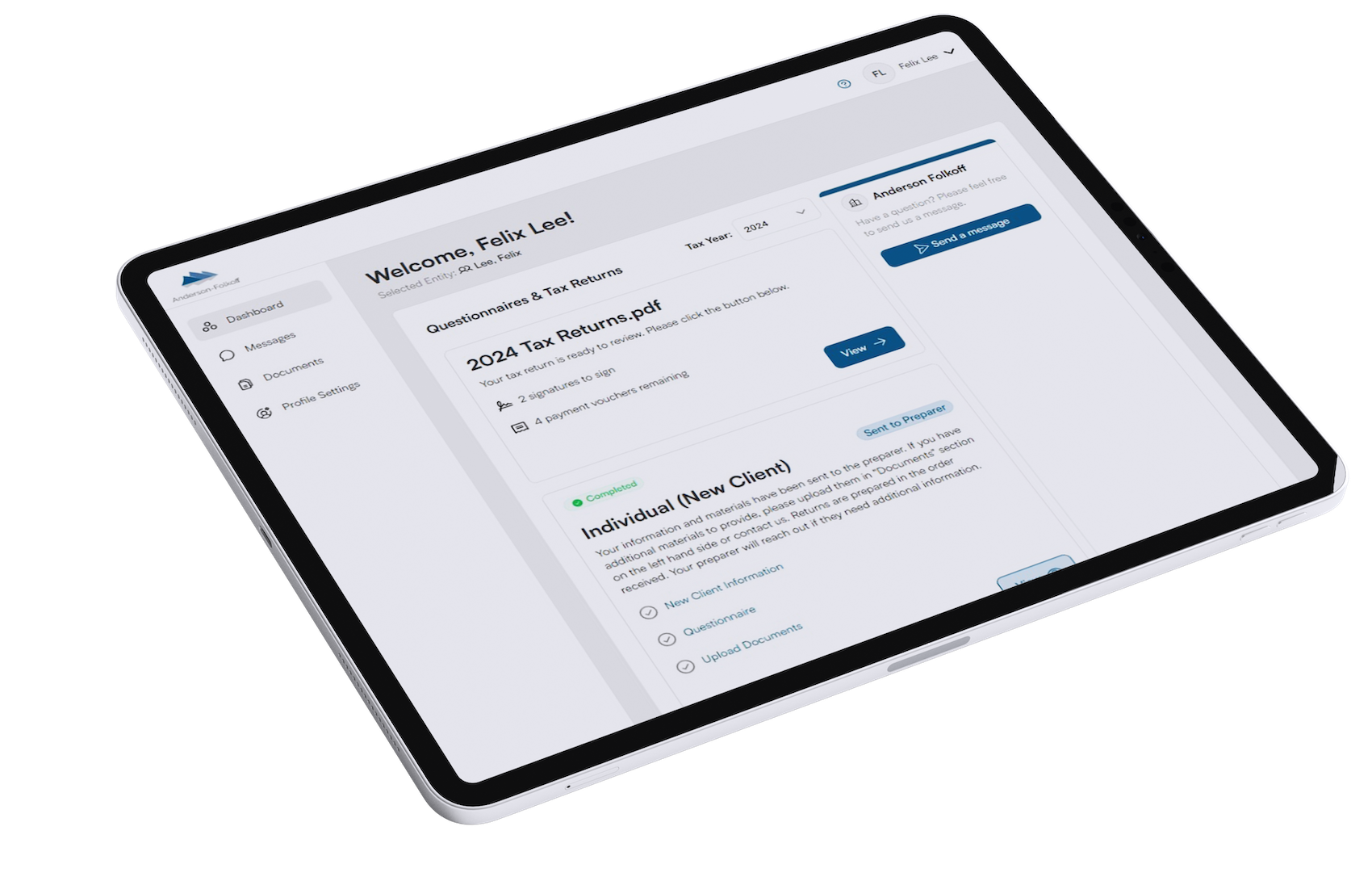

Client Portal

Securely and easily submit tax information and documents

Digitally sign your tax return and make tax payments online

Everything organized and easy to access in one place